3 big problems

Tell us your story

We need your help! We're looking for individuals to share personal stories about how they've been negatively impacted by their health insurance provider. Together we can expose the truth about this industry and advocate for prioritizing quality, affordability, and patient well-being over corporate profits.

A Minnesota Monster:

UnitedHealth exemplifies everything wrong with the insurance industry

Minnesota's own UnitedHealth Group is the subject of a U.S. Department of Justice antitrust investigation. It's about time.

UnitedHealth Group is the fifth-largest public company in the U.S. and one of the largest health care companies globally. It operates in several segments of the health care industry, often through its health services subsidiary Optum Health, headquartered in Eden Prairie, and it's one of the largest employers of physicians in the country.

UnitedHealth's extensive network raises concerns about self-selective practices, denying fair opportunities to external providers, and potentially compromising the quality of services provided. The Wall Street Journal recently reported the U.S. Department of Justice has launched an antitrust investigation into UnitedHealth Group.

Additionally, the DOJ is collecting health care competition complaints on their website. If you would like to submit a health care competition complaint form, please use the button below to submit through the DOJ’s website. The form is only to be used to submit complaints about health care competition, not complaints about failure to pay claims or cover health care services, increases in individual insurers’ rates, billing disputes, or general unhappiness about the healthcare system.

Who We Are

Health insurance companies should have one job: provide affordable medical care. Instead, they've inserted themselves into nearly every aspect of the health care system in order to maximize profits at the expense of patients and providers.

Patients United for Insurance Reform is a group of Minnesotans shining a light on all the ways for-profit health insurers are manipulating the system and putting profits over Minnesota's patients. We advocate for transparency, accountability, and a patient-centered approach to reshape health care and ensure the welfare of individuals takes precedence over corporate interests.

Health insurance should work for patients, it should be affordable, and it should do what it claims it will do—cover health care costs.

Denied care, divided nation—struggles of patients navigating insurance denials

Across the United States, patients and families are often confronted with insurance denials that delay or prevent critical medical care. Individuals in crisis are told their treatment is not “medically necessary,” or they discover too late that their coverage has been discontinued. While denials can come quickly, appeals can take months, leaving patients feeling that the system is difficult to navigate and sometimes unresponsive to their needs.

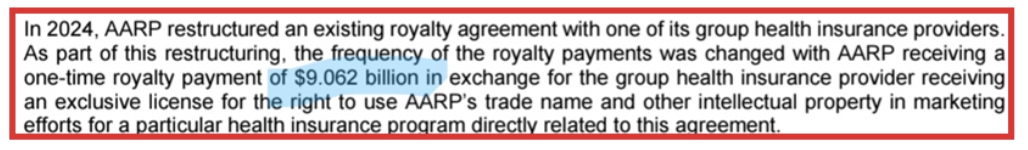

AARP under fire after $9 billion payment from UnitedHealthcare revealed

AARP is facing new scrutiny after disclosures showed it will receive $9 billion from UnitedHealthcare under a restructured deal to market AARP-branded Medicare Advantage plans.

Financial statements on AARP’s website show the agreement replaces monthly royalties with a one-time payment of just over $9 billion. The deal comes as UnitedHealth Group faces a criminal investigation by the U.S. Department of Justice over possible Medicare fraud.

Critics question whether the payment represents what one called a “tax-funded bribe” to keep AARP tied to UnitedHealthcare.

AARP Got $9 Billion From UnitedHealth Last Year

It turns out that AARP is in on the swindle in Washington to expand health care subsidies that will enrich the health insurers – like UnitedHealth.

And they are getting paid handsomely for it. Buried in the notes to AARP’s most recent financial statement was this revelation:

This massive sum was discovered by Chris Jacobs, who publishes an annual report on AARP finances for American Commitment.

Republicans found Medicare fraud – now what?

Republicans have found $124 billion in wasteful Medicare spending that enriches insurance companies at the expense of seniors and taxpayers. The only question is if they’ll take the savings or concede the insurance lobby’s claim that all efforts to rein in waste, fraud and abuse are “Medicare cuts.”

This choice will define Republican credibility on government waste for years to come. The opportunity is concrete and bipartisan.

The No UPCODE Act, introduced by Sen. Bill Cassidy, R-La., and Sen. Jeff Merkley, D-Ore., would directly attack Medicare overbilling. It ensures that patients are diagnosed by doctors, not insurance companies looking to maximize payments.

‘No UPCODE Act’ could be part of shutdown solution … and more

A veteran health insurance industry watchdog says one bill could play an important role in not only ending the shutdown but also fixing the health care system.

The No UPCODE Act (No Unreasonable Payments, Coding or Diagnoses for the Elderly Act) was introduced in March by Sen. Bill Cassidy (R-Louisiana) and Jeff Merkley (D-Oregon). The bill would improve how Medicare Advantage plans evaluate patients’ health risks, reduce overpayments for care and save taxpayers money by removing incentives to overcharge Medicare.

The bill, according to several experts, could save $124 billion in Medicare waste. That’s enough to both extend coverage and balance the budget.

Insurers Are Squeezing Doctors and Their Patients

As health insurers have consolidated and tightened their grip on the U.S. health care system – and in particular on physician practices – doctors increasingly have to spend their days battling red tape, fighting with insurers, and watching their reimbursements shrink while their operating expenses increase every year. Doctors who are determined to resist being bought by an insurer or large hospital system are finding it harder and harder to do so without outside investment.

UnitedHealthcare customers in Maryland feeling stressed after break with Johns Hopkins Medicine

Things were smooth sailing for [Marget’s] medical care at Johns Hopkins with her general practitioner coordinating the handful of doctors, her multiple tests and labs to ensure she’s staying healthy.

But months ago, she started getting letters from her insurance company, UnitedHealthcare, saying that negotiations between Hopkins and United weren’t going well. On Aug. 25, Hopkins went out of network for UHC members and the two stopped negotiations this month.

That’s left about 60,000 people in Maryland, D.C. and Virginia out-of-network for Hopkins care.

Report: $1.3 trillion in Medicare Advantage waste could fund Obamacare subsidy extension

The federal government will spend more than $1.3 trillion over the next decade on Medicare Advantage that won’t go toward patient care, a new report says.

The Proactive Strategies Group analysis outlines how Congress could target wasteful spending as part of a broader health care deal. It says reforms would not cut appropriate medical benefits, but instead eliminate improper payments, inflated bonuses, and self-dealing between insurers and affiliated providers.

AARP Medicare Advantage among the lowest-rated plans in key senior markets

AARP-sponsored Medicare Advantage plans are among the lowest-rated options in many of the nation’s largest senior markets, despite the organization receiving over $1 billion annually to endorse them.

The Centers for Medicare & Medicaid Services (CMS) finds that AARP’s co-branded plans with UnitedHealthcare crack the top 10 for quality in two of the 10 U.S. counties with the highest senior populations – Maricopa County, Arizona, and Dallas County, Texas.

In the other eight counties – including Los Angeles, San Diego, Orange, and Riverside in California, along with Miami-Dade, Florida, and Cook County, Illinois – AARP-backed plans don’t reach that threshold. Most of these plans have CMS star ratings between 3.5 and 4.0, while the highest-rated plans in those same counties score between 4.5 and 5.0 stars.

Poorly structured payments to insurers have yielded a massively expensive boondoggle, funding perks like trips to the links, ski passes, and pet food

Medicare is supposed to fund health-care services for elderly and disabled Americans. But poorly structured payments for Medicare Advantage—a program that pays private insurers to manage seniors’ health coverage—have led to taxpayer dollars increasingly being used for non-medical perks like golf equipment, ski passes, and pet supplies.

Medicare Advantage was intended to be a cost-saving alternative to traditional Medicare. But overpayments to plans have left taxpayers on the hook for an additional $1 trillion over the next decade. If Republicans want to make a real dent in the budget deficit—and head off Democratic plans to redirect the savings into expanding other social programs—they should move to rein in payments and use the savings to ease the burden on taxpayers.

Medicare patient wrongly sent to collections in dispute between two UnitedHealth Group entities

The Minnesota-based insurer said he owed $275. The surgery center in St. Cloud wanted another $3,300. UnitedHealth owns both and is now apologizing.

Pharmacist’s View: Minnesota pharmacies, patients demand reform

As an independent pharmacist, I have been watching companies like UnitedHealth Group consolidate their power over our health care system for the past 20 years. I can say unequivocally, from personal experience, that this consolidation is bad and only getting worse.

It should come as no surprise to anyone that Minnesota’s independent pharmacies are struggling to survive. A May 25 article in the News Tribune noted that Minnesota has lost nearly 400 independent pharmacies since 1996, more than any other state. These closures were due to unfair contracts pharmacy benefit managers forced pharmacies to sign.

Health Care’s Colossus: How UnitedHealth harnesses its physician empire to squeeze profits out of patients

It’s no secret that UnitedHealth is a colossus: It’s the country’s largest health insurer and the fourth-largest company of any type by revenue, just behind Apple. And thanks to a series of stealthy deals, almost 1 in 10 U.S. doctors — some 90,000 clinicians — now either work for UnitedHealth or are under its influence, more than any major clinic chain or hospital system.

But behind those statistics, there’s a lot UnitedHealth doesn’t want you to know. A STAT investigation reveals the untold story of how the company has gobbled up multiple pieces of the health care industry and exploited its growing power to milk the system for profit. UnitedHealth’s tactics have transformed medicine in communities across the country into an assembly line that treats millions of patients as products to be monetized.

Private Medicare Plans and Vertical Integration Yield UnitedHealth $15.8 Billion in Profits Between January and June

UnitedHealth Group, the largest health insurance conglomerate by far, continues to show how rewarding it is for shareholders when corporate lawyers find loopholes in well-intentioned legislation – and game the Medicare Advantage program in ways most lawmakers and regulators didn’t anticipate and certainly didn’t intend – to boost profits.

UnitedHealth announced this morning that it made $15.8 billion in operating profits between the first of January and the end of June this year. That compares to $4.6 billion it made during the same period in 2014. One way the company is able to reward its shareholders so richly these days is by steering millions of people enrolled in its health plans to the tens of thousands of doctors it now employs and to the clinics and pharmacy operations it now owns. This is the result of the hundreds of acquisitions UnitedHealth has made over the past 10 years in health care delivery as part of its aggressive “vertical integration” strategy.

11 arrested during protest at UnitedHealthcare HQ, alleging company is systemically “refusing to approve care”

Eleven protesters were arrested by Minnetonka police for blocking the street, according to the People’s Action Institute, which helped organize the protest as part of its Care Over Cost campaign.

The campaign says it aims to bring attention to the health insurance company’s “systemic practice of refusing to approve care through prior authorization denials or pay for care through claim denials.”

“Health insurance coverage has expanded in America, but we are finding it is private health insurance corporations themselves that are often the largest barrier for people to receive the care they and their doctor agree they need,” said Aija Nemer-Aanerud, campaign director with the People’s Action Institute.

Protesters say 11 arrested outside UnitedHealthcare HQ in Minnetonka

Protest organizers say 11 people were arrested Monday outside UnitedHealthcare’s headquarters in Minnetonka during an event spotlighting what critics say is a pattern of improper coverage denials by the nation’s largest health insurer.

Critics in recent years have focused on prior authorization rules that patients and health care providers say have wrongly led to coverage denials, blocking needed care in the process. Insurers contend the rules help control costs and can improve quality.

People’s Action Institute says it launched a campaign in 2022 to fight back against coverage denials by health insurers. After the protest at Optum headquarters in April, critics met with UnitedHealthcare executives, pushing to help individual patients and for broader reforms at the company.

Doctors speak: Inside our meeting with UnitedHealth Group

In June, a delegation of medical professionals, patients, community, and labor leaders met with the chief medical officers of UnitedHealth Group and UnitedHealthcare, and the CEO of OptumRx, to discuss the systemic issue of care delays and denials by UnitedHealthcare and demand change. UnitedHealth Group, which owns UnitedHealthcare and OptumRx, is one of the largest corporations globally and is headquartered in Minnesota.

We hoped that the chief medical officers who share our professional background would empathize with our experience and commit to making concrete changes, or at least acknowledge there is a systemic problem. They did not.

FTC report slams pharmacy benefit managers, says firms inflate drug costs, squeeze competitors

An ongoing Federal Trade Commission study finds pharmacy benefit managers may have inflated drug costs while squeezing independent pharmacies, enriching some of the largest companies in the country at the expense of patients.

The interim FTC report released Tuesday details the market influence of companies known as PBMs, which are hired and, in many cases, owned by health insurers to manage drug benefits within heath plans. Their roles include negotiating prices, setting co-pays for medications and creating pharmacy networks where patients can fill prescriptions.

Eagan-based Prime Therapeutics and OptumRx, a division of Minnetonka-based UnitedHealth Group, were two of six PBMs singled out in the report.

The Opaque Industry Secretly Inflating Prices for Prescription Drugs

Pharmacy benefit managers are driving up drug costs for millions of people, employers and the government.

The three largest pharmacy benefit managers, or P.B.M.s, act as middlemen overseeing prescriptions for more than 200 million Americans. They are owned by huge health care conglomerates — CVS Health, Cigna and UnitedHealth Group — and are hired by employers and governments.

The job of the P.B.M.s is to reduce drug costs. Instead, they frequently do the opposite. They steer patients toward pricier drugs, charge steep markups on what would otherwise be inexpensive medicines and extract billions of dollars in hidden fees, a New York Times investigation found.

UnitedHealth CEO Sold $5.6 Million in Shares the Same Day as Ransomware Attack

On February 21, the same day that a ransomware attack began to wreak havoc throughout UnitedHealth Group and the U.S. health care system, five of UnitedHealth’s C-suite executives, including CEO Andrew Witty and the company’s chief legal officer, sold $17.7 million worth of their stock in the company. Witty alone accounted for $5.6 million of those sales.

“He (Witty) sold the shares on the same day that he learned of the ransomware attack,” said Richard Painter, a professor at the University of Minnesota School of Law who is also the vice chair of Citizens for Responsibility and Ethics in Washington. “That’s not good. For the SEC to prove a civil case of insider trading they just have to prove that it’s more probable than not that executives acted on inside information. CEOs have got to be a heck of a lot more careful. You’re the CEO of a company, you should not be buying or selling the stock right in the middle of a material event like a ransomware attack. You’re asking for trouble. You’re going to end up with an SEC investigation. If that goes badly you could end up with a DOJ investigation.”

Senators are right to scrutinize UnitedHealth, Minnesota’s most powerful company

I hope Minnesotans read about the testimony of UnitedHealth Group CEO Andrew Witty at the U.S. Senate Committee on Finance Wednesday. It’s an eye-opener about the corporate practices of our Eden Prairie health insurance/big data/whatever behemoth.

Witty was on the receiving end of scathing comments from a bipartisan group of senators — and justifiably so.

The health insurer — which keeps growing like a voracious weed, encompassing physician groups, pharmacy benefits management and payments technology — has become too big to fail, evidenced recently by a major hack of it’s Change Healthcare systems.

UnitedHealth Grew Very Big. Now, Some Lawmakers Want To Chop It Down.

In health care, no one is bigger than UnitedHealth Group, the nation’s largest private health insurer and largest employer of physicians. The nearly $400 billion umbrella company also helps run hospitals, has rapidly acquired outpatient surgery centers, is expanding into home health services — and fell victim to a cyberattack this winter that brought the U.S. health-care system to its knees and has prompted congressional hearings this week.

Lawmakers in both parties said they’re unhappy about so much of America’s health system running through a single organization, making thousands of hospitals and doctors vulnerable to a single point of failure.

“It needs to be busted up,” Rep. Buddy Carter (R-Ga.) said at the congressional hearing on Change Healthcare this month, citing his frustrations as a practicing pharmacist who dealt with UnitedHealth and its subsidiaries.

UnitedHealth is “so damn big,” added Sen. Elizabeth Warren (D-Mass.), singling out the company’s $227 billion Optum division, which employs more than 90,000 physicians. “One in every 10 doctors in America has been sucked into the Optum system. Most patients probably don’t know that their doctors are working for a giant corporation bent on maximizing profit, instead of working for themselves,” Warren said.

Burnsville woman’s sinus surgery went great — until she got the $32,449 medical bill

Once her doctor recommended sinus surgery, and insurance confirmed prior authorization wasn’t needed, Christine Knirk focused on getting the procedure and getting better. The outpatient operation happened just over a year ago and has brought the medical relief Knirk sought.

But getting the procedure paid for by insurance has created months of aggravation for the 65-year-old Burnsville resident.

Knirk’s story is a window into the continuing — and perhaps growing — tension between health insurers and health care providers over coverage denials. Denials without a clear reason can be maddening for patients who are often left feeling helpless. It also highlights the lack of comprehensive public data on how often and why denials happen.

“We’ve always been frustrated with the lack of transparency … trying to figure out what are the types of services that are being denied and what are the reasons,” said Kaye Pestaina, a vice president at the California-based health policy group KFF.

UnitedHealth Chair, Executives Sold $102 Million in Stock Before US Probe Became Public

UnitedHealth Group Inc. Chairman Stephen Hemsley and three senior executives netted a combined $101.5 million from stock sales made over four months leading up to when the public became aware of a federal antitrust investigation.

The sales occurred between Oct. 16, a week after the largest health insurer in the US reportedly received notice of the Justice Department probe, and Feb. 26, the day before Bloomberg News and others published stories about the investigation. The stock dropped after the investigation was widely reported.

The PBM-insurer mafia comes for community pharmacies

UnitedHealth, CVS, and Cigna’s PBMs are using their market share and pull in Washington to drive one of the key levers to manage healthcare costs—independent pharmacies—out of business.

Pharmacy benefit managers (PBMs) are the shadowy middlemen who decide what drugs you can buy, where you can buy them, and at what cost—without disclosing how much they charge to your employer, to your doctor, or your pharmacist. And as HEALTH CARE un-covered has reported, the biggest PBMs are now owned by Big Insurance.

Denying Your Health Care Is Big Business in America

Should your insurance company be allowed to stop you from getting a treatment — even if your doctor says it’s necessary?

Doctors are often required to get insurance permission before providing medical care. This process is called prior authorization and it can be used by profit-seeking insurance companies to create intentional barriers between patients and the health care they need.

At best, it’s just a minor bureaucratic headache. At worst, people have died.

Wisconsin family speaks out against PBMs after the loss of their son

Cole was diagnosed with severe asthma at only a year old. He had just recently moved out on his own with opportunities to chase his dreams, until his life was cut short earlier this year.

“January 10, he went to the pharmacy to get his prescription and was told it was no longer covered by his insurance,” said Shanon.

He was told there was no alternative option and no generic drug would be covered. Cole didn’t know how to respond and couldn’t cover the extreme out-of-pocket cost of his Advair inhaler on a $19/hour income. An inhaler-dependent patient left the Walgreens Pharmacy with no medication. Five days later he suffered an extreme asthma attack and was taken to the hospital. He arrived at the Emergency Room lifeless and spent the next six days in the ICU on a ventilator.

“We were told he’s never going to wake up again,” said Bil.

UnitedHealth Group: vulnerable and ill-equipped to defend against modern threats like cyberattacks

UnitedHealth’s recent cyberattack underscores a critical truth: no entity, no matter how vast its resources, is immune to the ever-looming threat of cybercrime. This breach, resulting in the potential theft of sensitive patient data, is a stark reminder of the urgent need for comprehensive health care reform–and reining in the growing power for-profit corporations like UnitedHealth have over all of us.

For years, the health care industry has operated under a profit-driven model, prioritizing financial gain over patient well-being. This relentless pursuit of profit has left our health care infrastructure vulnerable and ill-equipped to defend against modern threats like cyberattacks.

UnitedHealth Faces Antitrust Probe by US Justice Department

The probe opens a new layer of scrutiny on the largest US health insurer that operates in pharmacy benefits, medical care, technology and other services. It emerged out of concerns about UnitedHealth’s acquisitions of health-care providers and data companies, according to one of the people, who asked not to be identified discussing information that isn’t public.

UnitedHealth has drawn criticism for years as it has expanded its reach across the health-care system. Best known for its UnitedHealthcare insurance unit that covers more than 47 million Americans, it gets a growing share of revenue and profits from health-services businesses under its Optum arm. Optum’s clinics, home-care services, drug plans and pharmacies frequently provide services to UnitedHealthcare members, allowing the company to turn expenses in its insurance business into revenue for Optum

U.S. Opens UnitedHealth Antitrust Probe

The Justice Department has launched an antitrust investigation into UnitedHealth, owner of the biggest U.S. health insurer, a leading manager of drug benefits and a sprawling network of doctor groups. The investigators have in recent weeks been interviewing healthcare-industry representatives in sectors where UnitedHealth competes, including doctor groups, according to people with knowledge of the meetings.

Building a Giant: Mapping UnitedHealth’s consumption of our health care system

After being sold to Optum, a subsidiary of the health care colossus UnitedHealth Group, naviHealth denied coverage for at least two elderly patients against their doctors’ advice, forcing them to accumulate tens of thousands of dollars in out-of-pocket expenses before they died, according to reporting from STAT News. Employees alleged that UnitedHealth executives pressured them to deny coverage or lose their jobs. The reports most recently led to a class-action lawsuit.

In short, naviHealth was transformed from a company meant to better manage post-acute care to a machine that maximizes profits. It was UnitedHealth-ified.

Minnesota is losing independent pharmacies, victims of scale, efficiency

Over the last decade, however, Minnesota has lost more independent pharmacies than any other state.

The demise of independent pharmacies in Minnesota and many other places is being hastened by another group of businesses — the PBMs.

Lawsuit against UnitedHealth Group of using faulty AI to deny Medicare patient claims

UnitedHealth Group limits the ability of its workers to deviate from the AI projections, according to the lawsuit. Citing the news article, the complaint says employees who don’t follow the model are disciplined and terminated, without regard to whether patients needed more care.

UnitedHealth pushed employees to follow an algorithm to cut off Medicare patients’ rehab care

The nation’s largest health insurance company pressured its medical staff to cut off payments for seriously ill patients in lockstep with a computer algorithm’s calculations, denying rehabilitation care for older and disabled Americans as profits soared, a STAT investigation has found.

UnitedHealth Group has repeatedly said its algorithm, which predicts how long patients will need to stay in rehab, is merely a guidepost for their recoveries. But inside the company, managers delivered a much different message: that the algorithm was to be followed precisely so payment could be cut off by the date it predicted.

The care was crucial. He had insurance. His hospital bill? A whopping $155,493.

The document from Allina Health arrived in February, stating the 61-year-old Woodbury resident owed the hospital a staggering sum — $155,493. It made no sense, Christensen said. He had coverage through his employer from a reputable health insurer. And the need for the care was undeniable; Christensen was hospitalized for about a month for treatment of a rare and deadly blood cancer.

But his insurer, Empire BlueCross BlueShield, refused to pay because Allina hadn’t obtained authorization for Christensen’s transfer to a new hospital, which happened about halfway through his inpatient stay. The company has a policy stipulating that when interfacility transfers aren’t approved, all claims for care at the second hospital can be deemed not medically necessary.

Generic drugs get a markup at CVS, Cigna, UnitedHealth report says

In theory, pharmacy benefit managers like to recommend generic drugs and keep prices lower than brand-name pharmaceuticals. But it doesn’t always work out that way when the same company owns a PBM and the retail pharmacy — it can be in the company’s interest to keep prices higher.

Health Care’s Intertwined Colossus

Today, United is the fifth-largest public company in the U.S., bigger than JPMorgan Chase. Its insurance products serve 50 million members, more than the population of Spain, and its $186 billion health services division, Optum, has 103 million patients, more than Vietnam’s population. Earnings came to $28.4 billion last year, putting it in the top 30 of companies worldwide.

United even has a bank. Optum Bank is a way for consumers to manage health savings accounts, but the company’s latest financial service is a payday loan system called Optum Pay Advance for independent physician practices. While they wait for reimbursement from United for their claims but have to make payroll, doctors can get money from United to tide them over … with 35 percent interest.

U.S. Department of Labor sues UnitedHealth Group over thousands of denied claims

“Large insurance companies continue to do all they can to deny, delay or reduce payments for emergency care,” Dr. Christopher Kang, president of the American College of Emergency Physicians, said in a statement. “Immediate action to strengthen enforcement of the prudent layperson standard and other existing laws can help hold insurers responsible for their rampant bad behavior and protect patient access to emergency care.”

CVS hellth – Corporate consolidation is ruining pharmacies and hurting patients

Underpayment from Caremark has caused many non-CVS pharmacies to close, creating “pharmacy deserts” in many urban neighborhoods and rural areas.

CVS Health has been able to achieve and abuse its power through a series of mergers and acquisitions. Had our existing antitrust laws — such as the Clayton Act — been enforced correctly, this consolidation should never have been allowed.

Minnesota Pharmacist’s View: Losing local pharmacies a hazard to Minnesotans’ health care

Three major companies control 80% of the prescription-drug market: Optum, ExpressScripts, and CVS Caremark. These companies leverage their dominance to engage in practices like “patient steering,” which is requiring patients to fill prescriptions at their pharmacies, even when it’s less convenient. “Spread pricing” is another tactic, whereby PBMs reimburse pharmacies like Kemper Drug an inadequate rate for dispensing certain drugs, which can lead to the pharmacies closing their doors.

According to a recent survey , Minnesota lost 30% of its independent pharmacies between 2010 and 2019, which is the most of any state. In a recent two-week period, at least six independent pharmacies closed in the state. This loss of local pharmacies has been especially hard on rural areas, where alternate options are few and very far between.